Netcompany-Intrasoft has made commercially available the PROFITS® for Credit Servicers, a comprehensive and integrated solution for managing Performing and Non-Performing Loans, utilizing the powerful Loans Management functionality of PROFITS® Core Banking.

PROFITS® for Credit Servicers has been proven to be the system of choice of major Credit Servicers in Europe, facilitating yield of maximum Non-Performing Loans (NPLs) value recovery, and thereby reducing the risk of the crisis, while eliminating complexity and minimizing the cost of the technology investment.

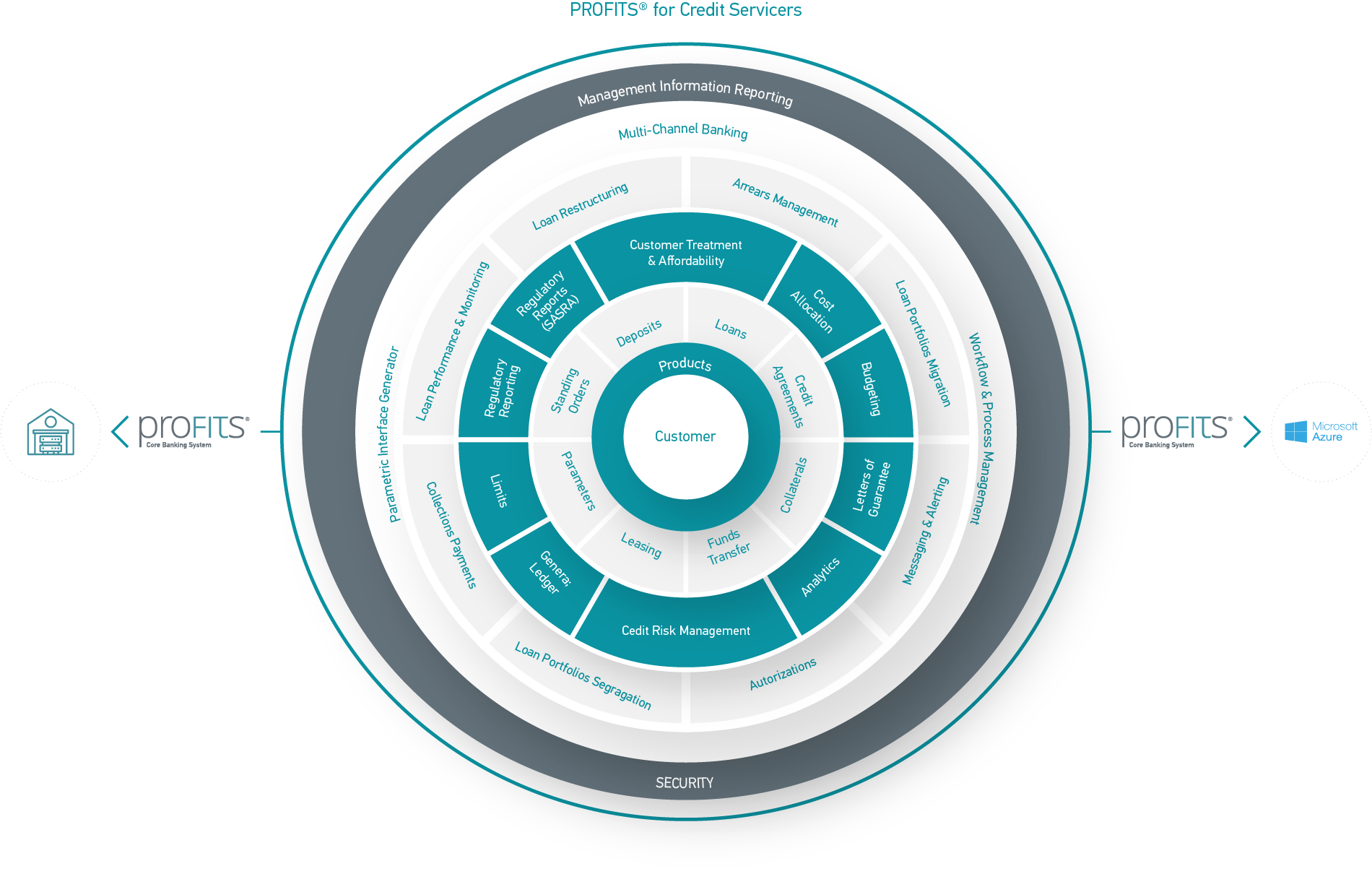

PROFITS®, Netcompany-Intrasoft’s own Core Banking System, consists of a full set of components (subsystems or modules), seamlessly integrated to each other covering, in a modular manner, all core and near core banking functionality of a Banking Organization. Due to this architecture, PROFITS® can be installed either fully, covering the whole business of a Banking Organization or by component in accordance with their needs. In this context, PROFITS® for Credit Servicers consists of a set of PROFITS® components (lending and others) inheriting all PROFITS® Technical and Functional characteristics.

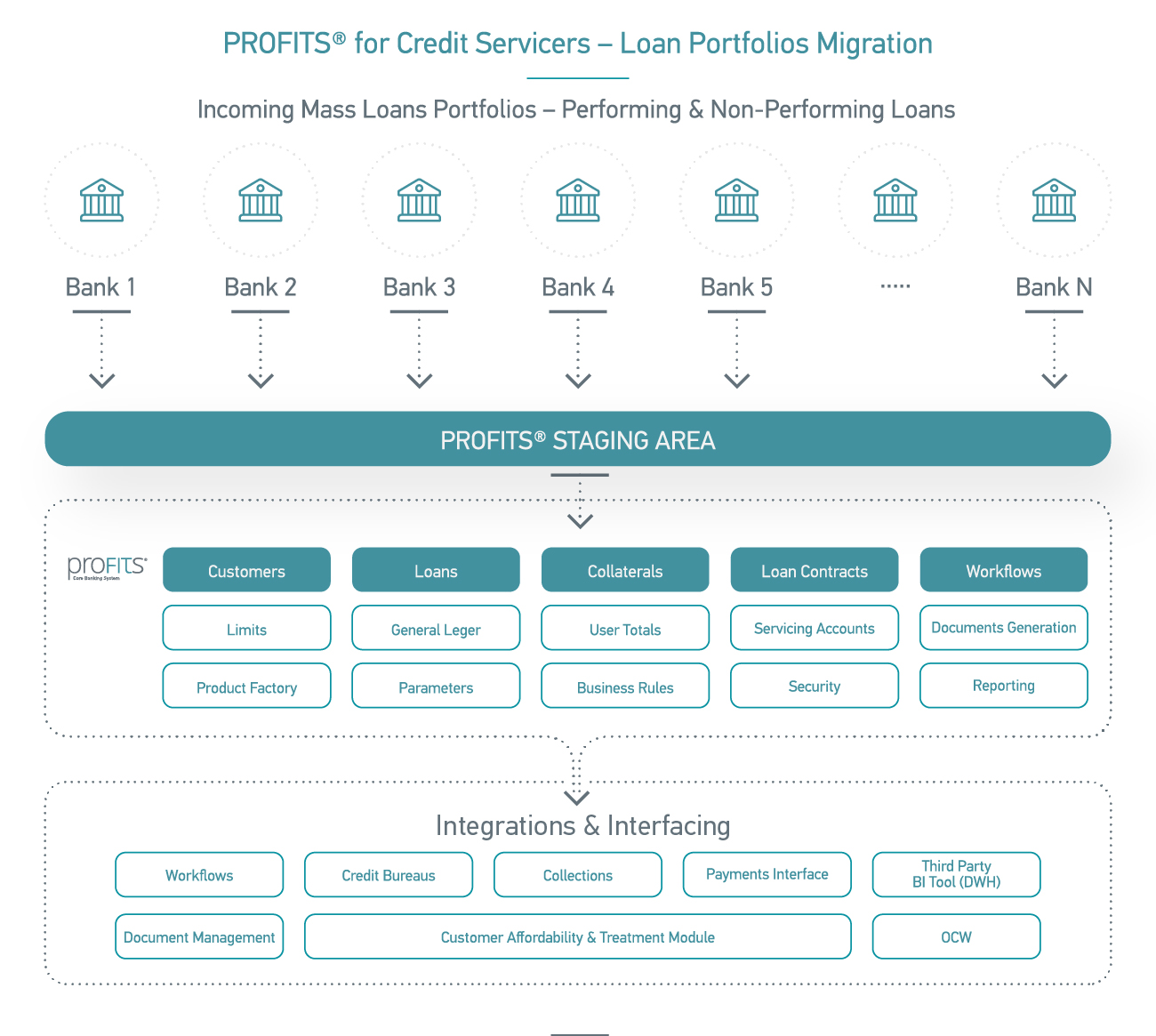

Netcompany-Intrasoft appreciates the fact that Credit Servicers need solutions to help them migrate, and manage large volumes of multiple loans portfolios. Therefore, it provides technology designed to cover efficiently the migration of complex loan portfolios, Loans Restructuring, Customer Relationship, and monitoring functions that are critical for their core business.

PROFITS® for Credit Servicers is built around a single customer view that fully covers all loan product lines and channels, enhancing the ability of the Credit Servicer to understand its customers’ needs and enhance personalization of services. PROFITS® for Credit Servicers provides a complete Loan restructuring workflow, integrated with a robust Customer Affordability & Treatment module based on AI/ML technology, to handle efficiently the entire NPL management life cycle.

PROFITS® Loan Management engine enables Credit Servicers to maximize loan recoveries and minimize the risk of restructuring and processing loans, while enhancing the profitability of loans recovery and supporting all types of loans throughout the life cycle of NPL management.

The concept of Business Rules processing is a fundamental architectural concept of PROFITS® for Credit Servicers. It is widely used across every subsystem and drives the dynamic definition (by configurable services) of application logic, interfacing with 3rd party systems and applications, accounting processing, authorization, reporting, online document creation etc.

PROFITS® has a rich set of integration features (i.e., interfacing with 3rd party systems or applications) in SOA (readymade APIS) and Non-SOA (any type of file exchange, any type of messages including ISO 8583 and variations, etc.) modes. PROFITS® open architecture delivers the agility and ability to integrate and innovate. Having available a significant number of powerful APIs that are accessible by third party systems and applications provides efficiency in integrating with credit rating agencies, collections systems, reporting systems, law offices, banks, AML systems etc.

PROFITS® for Credit Servicers can be delivered either on-premise or on Cloud on a SaaS model. With PROFITS® for Credit Servicers on Cloud and an SaaS model, Credit Servicers will avoid upfront investment related to licenses and implementation services, infrastructure and maintenance costs, and the need for allocating specialized IT personnel.

PROFITS® can be deployed in a variety of technological platforms, Mainframe, Unix, Microsoft environments and Relational Database Systems, such as DB2, Oracle, SQL Server.

Whether it deals with 100 or 100,000 Non-Performing Loans, one or multiple loans portfolios, PROFITS® for Credit Servicers displays and manages data with ease, being a platform for a competitive advantage, operating through frictionless user journeys and fresh designed dashboards.

Netcompany-Intrasoft provides maintenance and support services to Credit Servicers for their day-to-day operations. Furthermore, Netcompany-Intrasoft offers services for the migration of new Loan Portfolios, having professional experts with considerable experience and skill sets to advise on complex processes and performance improvements, as well as to help the maximization of loan recovery.

Netcompany-Intrasoft has available a robust and comprehensive Credit Servicers - specific regulatory compliance framework, covering regulations of domestic laws, as well as the capability to meet the needs of any regulatory framework internationally. Netcompany-Intrasoft's international offices, ensure that local liaisons with law experts and legal consultants will be in place, to support local extensions and peculiarities. Netcompany-Intrasoft's vast expertise ensures that clients can manage complex obligations and respond efficiently and effectively to regulatory authorities.

Our Software applications are designed with security by design, under a robust framework of security principles, ensuring their Secure Software Lifestyle (SSDLC).